Current Events and Looking Forward

Several current events are weighing on the markets: primarily, inflation concerns and the Federal Reserve's likely response to curb inflation, as well as continued geopolitical tensions stemming from Russia (and the potential repercussions from any of the above).

Given the events of the last 24 hours, let's start with the Russian invasion of Ukraine. Russia confirmed it was conducting a "special operation" to protect the eastern Donbas region. Conditions in Ukraine rapidly deteriorated overnight with the Kyiv government citing a full scale invasion and Ukraine's ambassador to the UN saying "it's too late for de-escalation." Ukraine declared martial law and closed its airspace to civilian flights. Global and domestic markets experienced a sharp sell-off--although by the 4pm eastern time close of the US markets, domestic stocks rebounded sharply to close mostly positive with the Nasdaq making the sharpest head-snapping move (down 3.5% at the low, closing 3.3% positive).

Inflation has continued to show signs that it isn't as "transitory" as Federal Chairman Powell once predicted, and the Federal Reserve has continued to wind down its quantitative easing (QE) program while broadcasting an expectation to raise the Federal Funds overnight lending rate as early as next month. Around a month ago, the consensus estimate showed a 66% likelihood that the Federal Reserve would increase rates by 50 basis points in March. Today, that estimate dropped to 6% with the strong majority expecting a 25 basis point increase. Notably, though, the interest rate forecasts for the year remain largely unchanged with Wall Street currently expecting 5 to 7 rate hikes in 2022 and a Fed Funds rate of 1.75 to 2% by year-end. We believe the market already has these expectations priced in. Also notable is the thought (as shared with us today by Dr. David Kelly of JP Morgan) that the Russian/Ukraine crisis will continue to drive energy prices up, which negatively impacts the economy, and might allow the Fed to take a softer approach (at least in the near term) to their inflation-dampening efforts.

So what to make of the volatility?

A Look Backward: Market Corrections in Historical Context

First, let's define a correction versus a bear market. Market corrections are classified as a 10% or greater pullback from a recent market peak. Bear markets are more severe sell-offs where the peak-to-trough decline exceeds 20%.

In the last 50 years, there have been 19 market corrections and 8 bear markets.

On average, the 19 market corrections lasted about 4 months with peak to trough declines of 14%. The recoveries were also relatively quick, reversing losses in about 5 months.

In 7 of the 19 corrections, the timeframes were condensed from average with the peak to trough lasting less than 2 months and the average recovery time in those instances taking around 3 months. These quick corrections and recoveries underscore how costly it can be to get out of markets during a pullback, risking also being out during a quick rebound.

The most recent correction prior to the pandemic was in late 2018, which was spurred by US trade tensions with China, slowing global growth, and concerns that the Federal Reserve was hiking rates too quickly. This particular correction was almost a bear market, as the peak to trough move was 19.8%. The recovery took about 7 months.

There were 6 market corrections in the 2010s. Nonetheless, the S&P 500 collected a total return of 256% over the decade.

Bear Markets in Historical Context

Bear markets are considerably more severe and leave a longer-lasting impact on the market. The average decline realized during the 8 bear markets since the late 1960s was around 28%. The slide downward took an average of 14 months with the average recovery playing out over 29 months.

Bear markets are typically tied to major structural issues in the economy or extreme market excesses. Recent examples include the tech bubble of the late 1990s/early 2000s where extreme enthusiasm over anything "dot com" led to a market bubble in internet company stocks, and the 2008 financial crisis where lax lending standards (remember the "NINJA loan"...No Income, No Job or Assets? No Problem!) and overleveraged financial systems (in the US and worldwide) unraveled, leaving many homeowners owing more on their mortgage than their home was worth and financial institutions holding trillions of dollars of near-worthless subprime mortgages and derivatives.

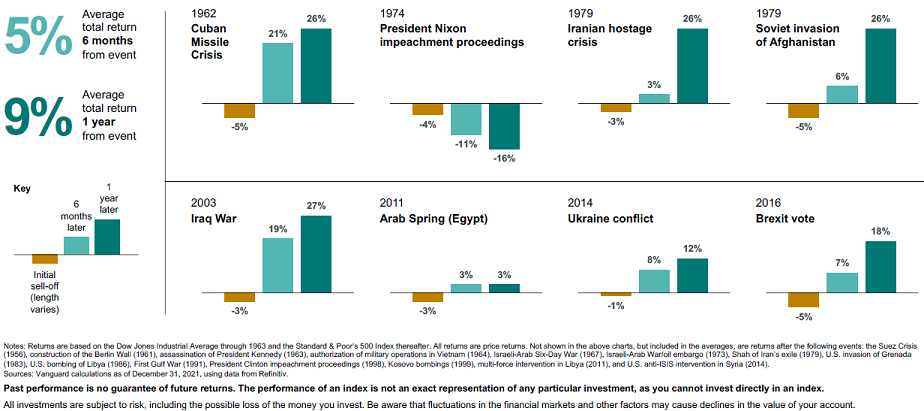

Illustrations: Geopolitical Sell-offs are typically short lived

Source: Vanguard

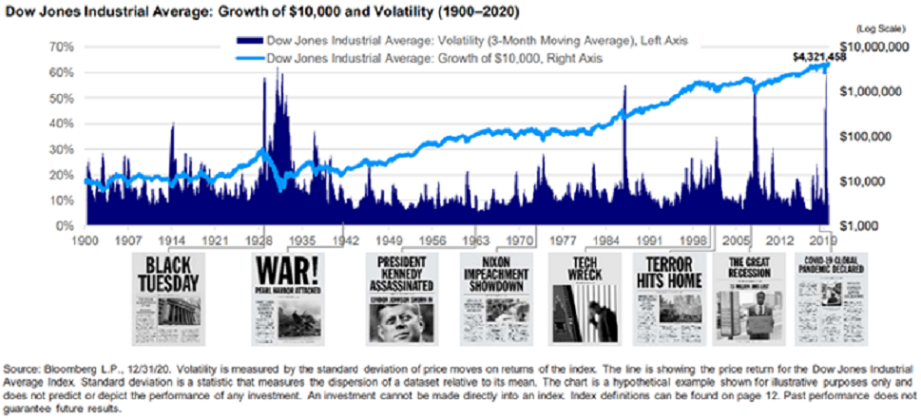

DJIA: Growth of $10,000 and Volatility 1900 - 2020

Source: Invesco

Our Current Conclusions

Market volatility is familiarly uncomfortable. The causes for the volatility, and perhaps more accurately, the causes for downward pressure, are concerning because as we live through them in the current time, we don't know when the downward slide will end.

Inflation remains a concern, and we think the Federal Reserve has a tough job ahead as it curbs inflation without stifling the economy.

The potential for added geopolitical pain most definitely remains, but--purely from a financial perspective--history tells us that long-lasting repercussions for the financial markets are highly unlikely.

With all of this acknowledged, we do not believe that we are headed toward the calamity seen in prior bear markets. Pockets of excess in the financial markets may remain, but buying opportunities also exist and are likely to continue surfacing. The US economy is strong. The consumer remains strong with healthy balance sheets and low debt. Financial institutions remain well-capitalized.

We continue to tweak portfolios where we see opportunities (and the mutual funds held in your portfolios do the same even if you don't see the transactions because they're embedded within the funds themselves), and we will continue to remain in touch. Please contact us directly if you would like to discuss any of the above or your specific situation.

Respectfully,

Cerro Pacific Wealth Advisors

This report is provided for informational purposes only, is not an offer or solicitation to buy or sell securities, and should not be relied upon to make any investment decisions. This material is not a replacement for your statement or communications with your advisory team. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal. Please contact us at 805-457-3300 at your earliest convenience with any questions regarding this report. Copyright © 2021 Cerro Pacific Wealth Advisors, All rights reserved.