Market Update

Today, Friday, capped off a volatile week on Wall Street. Stocks celebrated on Wednesday after the Federal Reserve announced a 50 basis point rate increase (a rate increase that was broadly expected). Stocks reversed course on Thursday, seemingly out of concern that inflation and the Federal Reserve’s fighting of inflation will ultimately lead to a recession. By the end of the week, the S&P 500 was down around one half of one percent from the start of the week, albeit with some major swings in the middle.

Year to date, the S&P 500 is down around 13.5% while the more growth-oriented NASDAQ is down around 22.4%. The MSCI All Country World Index (ACWI), a market cap weighted index of publicly traded companies around the world, is down just shy of 14% for the year.

Since World War II, there have been 23 periods where the S&P 500 has declined 10 – 20% (by definition, a 10 to 20 percent decline is termed a “correction”). On average among these 23 corrections, the S&P corrected by 14% and took four months from peak to trough...and then proceeded to recover the entirety of the losses over the course of four more months.

We don’t know if the correction we are currently in will follow the average or when the market bottom will arrive. But we do know that historically recoveries have been fairly swift, and we believe that we are closer to the end than to the beginning of the current sell-off.

As we head into the weekend, we offer a few points from our colleagues at JP Morgan below, cited from Dr. David Kelly’s Guide to the Markets. If you would like a copy of the entire guide then please email our office and we’ll send it to you.

The U.S. economy can absorb the Ukraine shock without falling into recession

In early 2022, just as the latest COVID-19 wave began to fade, the world was hit by another shock – Russia's invasion of Ukraine. While the financial market implications of this action pale in comparison to the suffering of the people of Ukraine, it will still have significant effects.

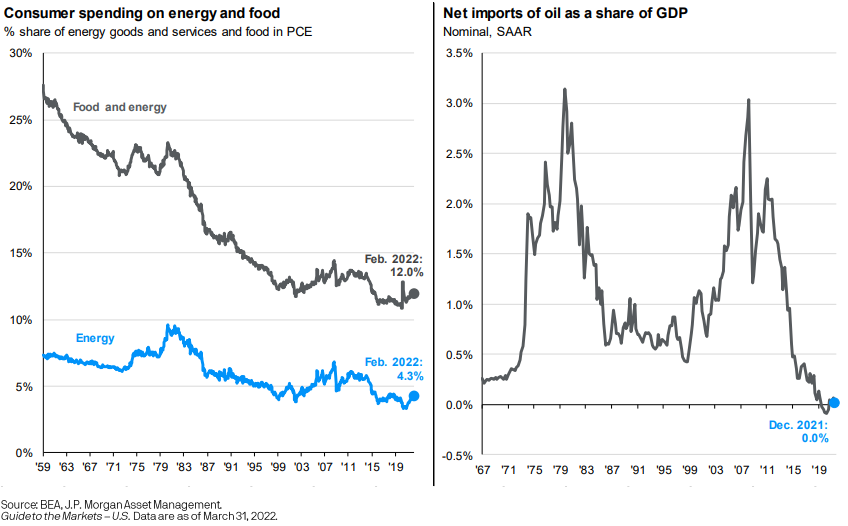

For the U.S., the most impact is via higher energy prices as Russia is a major global supplier of oil and natural gas. However, while higher energy prices could slow the European economy, they should have a smaller impact on the U.S. In part, this is because the energy share of household budgets has been declining for years and, by February of 2022, accounted for just over 4% of U.S. consumer spending.

In addition, the growth in U.S. shale oil in recent years means that the U.S. is now essentially self-sufficient in oil. In the 1970s, when oil prices spiked, American consumers got poorer and foreign oil producers got richer with close to 3% of GDP being devoted to buying foreign oil. Today, when oil prices spike, U.S. producers get richer, allowing purchasing power to stay in the U.S. This diminished vulnerability to an oil shock, combined with substantial pent-up demand for services and workers, should allow the economy to keep growing despite the disruptive effects of the war in Ukraine.

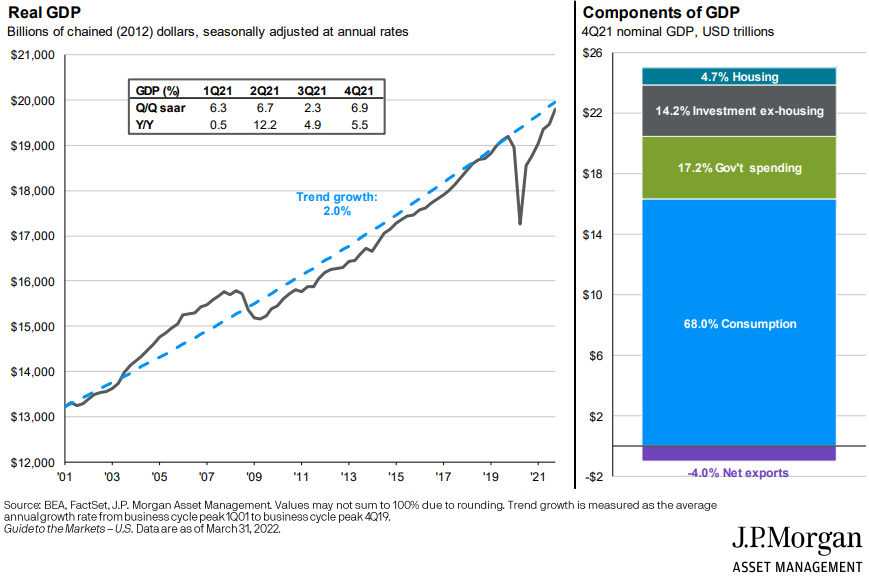

The US economy will continue its rebound until it reaches capacity limits

The economic recovery from the pandemic recession has been very bumpy with surges in economic output being impeded by supply shortages and curtailed by new waves of the virus. However, by the end of 2021, the U.S. economy had not only recovered its pre-recession output level but had exceeded it by 3.2%. Importantly, part of this recovery is due to productivity gains – over the past two years, output per worker has grown at an annual rate of 2.7%, more than twice the 1.2% growth seen in the first two decades of this century.

The Omicron wave appears to have slowed the economy in the first quarter of 2022. However, we expect strong growth in the second quarter spurred by robust consumer and business spending. Thereafter, growth should fade as the economy reaches capacity limits, primarily due to a shortage of workers and fiscal and monetary policy turn more restrictive. By the fourth quarter of 2022, we expect real GDP growth of 3% or less, on a year-over-year basis with growth slowing further to a roughly 2% pace in 2023.

Don't let how you feel about the economy overrule how you think about investing

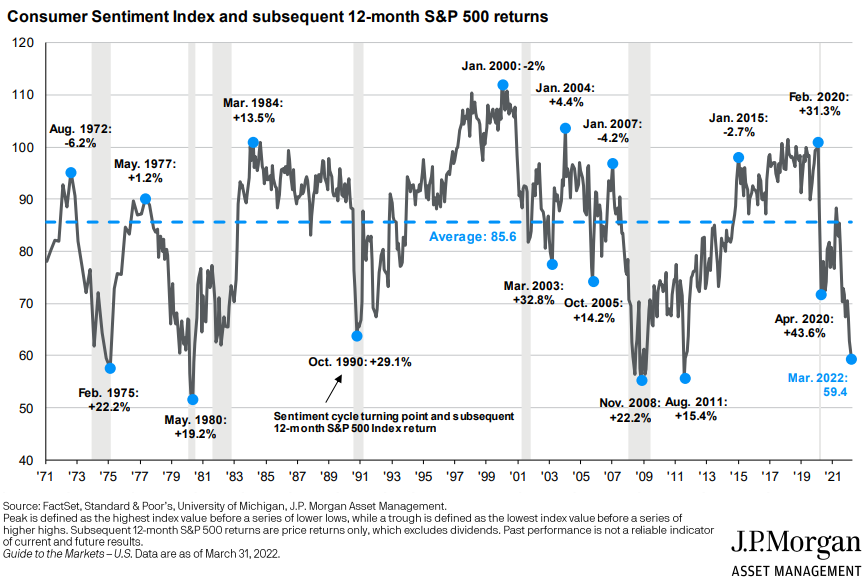

For many Americans, 2022 has begun in a troubling and disappointing way with the Omicron variant prolonging the pandemic, rising inflation and the shock of Russia’s brutal invasion of Ukraine. This, combined with a still very partisan political environment has driven consumer sentiment down to its lowest level in over a decade.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets in general and stocks in particular. However, history suggests that trying to time markets in this way is a mistake. The slide below shows the University of Michigan index of Consumer Sentiment stretching back over the past 50 years with eight distinct peaks and troughs noted. We also show how much the S&P 500 went up or down in the 12 months following the peaks or troughs. On average, buying at a confidence peak yielded a return of 4.4% while buying at a trough returned 24.5%.

This is not to argue that U.S. stocks will return anything like a 24.5% return in the year ahead. Many other factors will determine that outcome. However, it does suggest that in planning for 2022 and beyond, investors should focus on what they own and valuations rather than when to buy and sell and how they feel about the world.

Our Current Conclusions

As we've said before, market volatility is familiarly uncomfortable. The causes for the volatility, and perhaps more accurately, the causes for downward pressure, are concerning because as we live through them in the current time, we don't know when the downward slide will end.

We will continue to tweak portfolios and we will remain in touch. Please contact us directly for further conversation that is pertinent to you.

Respectfully,

Cerro Pacific Wealth Advisors

This report is provided for informational purposes only, is not an offer or solicitation to buy or sell securities, and should not be relied upon to make any investment decisions. This material is not a replacement for your statement or communications with your advisory team. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal. Please contact us at 805-457-3300 at your earliest convenience with any questions regarding this report. Copyright © 2021 Cerro Pacific Wealth Advisors, All rights reserved.